On a soft day of performance in the equity markets, when the S&P 500 dipped alongside the Nasdaq and the Dow 30, Apple stock headed in the opposite direction. Shares of the Cupertino company climbed 0.9% to breach $145, as market cap fast approaches $2.5 trillion.

Before the opening bell on Wednesday, July 14, the Apple Maven looks back at recent gains and asks the question: is this still a good time to own AAPL?

(Read more from the Amazon Maven: Apple Earnings Preview: A Yellow Flag Has Been Raised)

The Apple Maven saw it coming

Mad Money’s Jim Cramer has recently criticized the financial news media for piling up on Apple stock when it reached a 2021 low of $116 apiece on March 8. According to him, that was the time to buy AAPL on weakness, not to sell on desperation.

The Apple Maven was one of the few bullish voices to see upside opportunity back then. Below are the five key reasons why this channel was optimistic about the stock, when most saw reasons to dump it:

- Despite the selloff, fundamentals remained intact, with earnings estimates rising in Q1;

- Bearishness on iPhone 12 sales seemed premature – and they were proven so on earnings day;

- The stock seemed to have found a trailing P/E floor of 33x, never dipping below the level;

- AAPL’s performance tends to improve after the post-holiday winter months;

- The best one-year returns in AAPL have come after a dip of 15% or more from the peak.

(Read more from the Apple Maven: History Says: Buy Apple Stock Before Earnings)

Where the Apple Maven stands

The Apple Maven remains bullish on Apple stock. First and foremost, we think that AAPL is a stock to hold, not to trade. Business fundamentals remain strong – even though comps will begin to tighten, making 2021 results look a bit less appealing.

That said, it is prudent to expect a bit less of the stock now that it has rallied 25% from the lows of the year. Back to the list of five key reasons above, three have become largely irrelevant for the bull thesis:

- The valuation floor is no longer a reason to buy AAPL. In fact, forward P/E has expanded four turns since early June, making shares more expensive;

- The winter season has come and gone and, once again, Apple shares performed well after it. While July and August still tend to be strong months for AAPL, some of the upside seems to have been already captured;

- Buying AAPL at peaks is not necessarily a bad idea, but historical one-year returns have been nearly 20 percentage points worse than when shares are bought after a 15% decline.

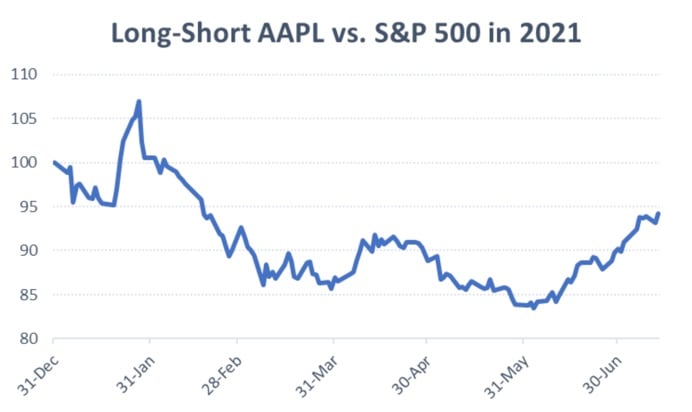

Below is a graph depicting the outperformance of Apple stock over the S&P 500 since late May. The 13-percentage point advantage over the benchmark during the period represents Apple’s best returns relative to the broad market in 2021.

Will the stock continue to beat the S&P 500 going forward? Momentum suggests that it very well may. But the higher the share price rises, the more certain investors can be that most of the alpha may now be in the rearview mirror.

Twitter speaks

The Apple Maven remains bullish on Apple stock, despite shares having reached all-time highs once again. At a current market cap of nearly $2.5 trillion, how much can AAPL climb through the end of 2021?

Explore more data and graphs

I have been impressed with the breadth and depth of information on markets, stocks and ETFs provided by Stock Rover. Stock Rover helps to set up detailed filters, track custom portfolios and measure their performance relative to a number of benchmarks.

To learn more, check out stockrover.com and get started for as low as $7.99 a month. The premium plus plan that I have will give you access to all the information that goes into my analysis and much more.

(Disclaimers: this is not investment advice. The author may be long one or more stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not influence editorial content. Thanks for supporting The Amazon Maven)