Apple’s Shareholders Meeting: This Is What Mattered Most

On February 23, Apple held its 2021 annual meeting of shareholders. Today, the Apple Maven reviews some of the key takeaways from the event – and singles out the topic that I believe mattered most.

Key topics of discussion

I will leave what I consider to be the best for last (see section further below). However, a few other subjects came up during the meeting that are worth mentioning:

- Housekeeping items: shareholders of record as of December 28 cast a couple of key non-binding votes. One of them was to re-elect the company’s board of directors. The second was to approve executive pay, which included the discussion on a generous equity package that could be paid to CEO Tim Cook in the future.

- Social responsibility: a couple of items that usually do not impact financial results directly came up, as CEO Tim Cook addressed environmental standards goals and privacy. The head officer reinforced the company’s commitment on both fronts, and highlighted some key accomplishments.

- M&A: Apple is not known for making large acquisitions – the most significant one was the purchase of Beats for “only” $3 billion, in 2014. But Mr. Cook addressed the topic during Q&A. The following quote summarizes his thoughts on the matter:

“We’re not afraid to look at acquisitions of any size, but our priority is on valuation and strategic fit, and our focus is generally going to be on small, innovative companies exploring technologies that complement our products and help push them forward.”

Focus on dividends

Finally, Tim Cook answered a very interesting question about dividends: “why don’t you increase your dividend more?”

This is exactly what I argued for, back in August 2020. I went further and provided specifics, saying that Apple should double its dividend payments to shareholders.

Currently, the stock yields only 0.7% — enough to consume nearly 20% of Apple’s free cash flow in fiscal 2020, but nowhere near enough to make Apple stock attractive to dividend-seeking investors.

Here is what the CEO had to say:

“Our primary focus is on long-term value. That said, we are proud of our record as one of the largest dividend payers in the world. We plan for annual dividend increases, but we don’t think that dividends are the only way that we can create value for shareholders. A much more important one in our view is continuing to invest in innovation and in the technological breakthroughs that will drive apple’s next generation of success.”

What it means

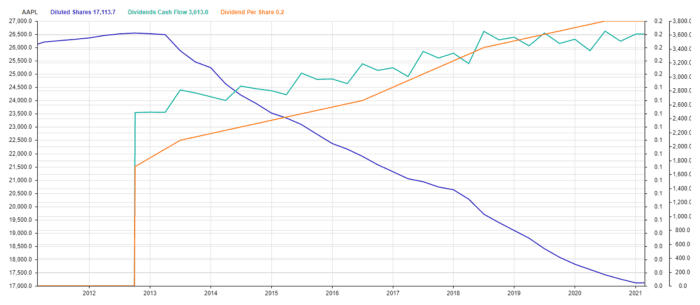

I interpret this statement to mean two things. First, Apple will continue to focus on dividend hikes. The company has bumped the per-share dividend amount by an average of 9.5% per year for the past five years, and by 6% between fiscal 2019 and 2020.

However, a pickup in the pace of the increase is unlikely. Instead, Apple will probably plow excess cash back into the business, assuming investment opportunities exist – and they should.

To reiterate, I think that investing in the business for future growth makes sense. However, I continue to think that Apple could and should ramp up its dividend payments at the same time.

This is especially true because the Cupertino company has reduced the share float substantially since Tim Cook took over, in 2012 (see chart below). Therefore, with fewer shares outstanding, Apple does not need to overstretch its balance sheet to produce a better dividend yield and increase demand for its stock.

Read more from the Apple Maven:

(Disclaimers: the author may be long one or more stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not influence editorial content. Thanks for supporting The Apple Maven)